Real estate magnate wins bidding for Tribune

By Thomas S. Mulligan and James Rainey

Times Staff Writers

9:52 AM PDT, April 2, 2007

Billionaire real estate mogul Sam Zell has reached an agreement to buy Tribune Co. in a two-stage deal valued at $8.2 billion, or $34 a share, the company said this morning.

Tribune, owner of the Los Angeles Times and KTLA-TV Channel 5, also announced that it would sell the Chicago Cubs baseball team after the 2007 baseball season and the company's 25% interest in its regional cable sports network.

The deal, worth about $13 billion including Tribune's nearly $5 billion in existing debt, would put a 65-year-old entrepreneur famed for turning around troubled properties at the helm of the nation's third-largest newspaper chain and one of its largest conglomerations of television stations.

Zell's offer was sweetened over the weekend to top an eleventh-hour proposal from Los Angeles billionaires Eli Broad and Ron Burkle.

Tribune's board deliberated late into the night Sunday to arrive at a decision that would bring the six-month auction to a close, one day after the company's self-imposed March 31 deadline.

Pending regulatory and shareholder approvals that could take months, Zell would take control of the company in partnership with a newly formed employee stock ownership plan, or ESOP. The new Tribune would be privately held and run by Zell in conjunction with the ESOP, which would be represented by an independent trustee.

The deal represents the second potential sale in a little more than a year of one of the nation's top newspaper operators. McClatchy Co. of Sacramento bought Knight Ridder Inc., previously the second-largest chain by circulation, in March 2006. But McClatchy's subsequent swoon on the stock market – and Tribune's trouble finding a buyer, despite its roster of marquee assets – became emblematic of the decline plaguing old media companies trying to compete with the Internet.

The transaction would mark a watershed for both Chicago and Los Angeles. It would turn the 160-year-old Tribune and its flagship Chicago Tribune, a major economic and political powerhouse in the Midwest, over to a quirky businessman whose previous investments have not had nearly such a high public profile.

And the deal would effectively liberate the Chandler family of California – owners of the Los Angeles Times for more than a century – from a newspaper business with which they have become disillusioned. For the second time in seven years, the Chandlers helped push The Times into the hands of new, Chicago-based owners.

In 2000, the pioneering Los Angeles family sold its control of Times Mirror Co. to Tribune. And the Chandlers' remaining 20% stake in Tribune still gave them enough leverage to demand the strategic review that that would end with this sale. The auction did not turn into anything like a bidding contest until Broad and Burkle submitted their revised offer, which they valued at $34 a share, or $8.1 billion, late last week.

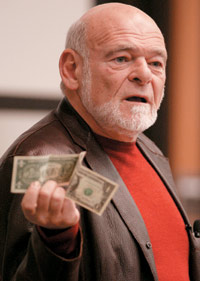

Zell, a maverick who fancies Ducati motorcyles, leather jackets and rousing games of paintball, had himself not entered the bidding until early February, after Tribune's deadline for offers.

Zell made his move at a time when he was still negotiating the second-biggest leveraged buyout in history – the sale of his Equity Office Properties Trust commercial real estate empire for $23 billion to Blackstone Group, a New York private equity firm.

Several private equity firms and newspaper industry giant Gannett Co. had taken a look at Tribune but backed away from bidding on the whole company. The fragmentation of audiences and advertising leakage to the Internet scared off many potential investors.

But Zell said he saw reason to be hopeful about the company's prospects, and he has told executives in the company that he has particularly high hopes for Tribune's Internet holdings, which include 42.5% of the largest online job search site, CareerBuilder.com.

He said in an interview with the Associated Press last month that he was more bullish on the company's core businesses than most. "I just think that newspapers are a part of our life and they're a part of our culture and a part of our society," Zell said, "and there will always be a place for them."

Although Zell had indicated earlier that he was not looking at the company from "a breakup perspective," wealthy individuals and groups in several cities have expressed an interest in buying some of Tribune's papers and might press the new owners to sell to them.

Burkle and Broad have said they were principally interested in Tribune to obtain the Los Angeles Times and maintain it as a first-rate newspaper. Billionaire entertainment mogul David Geffen offered the company $2 billion for The Times alone and has given no indication he has lost interest in acquiring the paper.

Such local buyers have come to be seen as one of the last groups still interested in newspapers. Tribune's operating profit has dipped from its 2003 high of $1.36 billion to $1.09 billion in 2006. The falloff in newspaper advertising continued, or even accelerated, in the first months of 2007.

Those declines have been reflected in the price of Tribune shares, which reached nearly $52 a share in spring 2004 but languished below $28 last year before a stock buyback and attendant protests by the Chandler family kicked off the auction.

Tribune became a publicly traded company in 1983, thriving on 20%-plus profit margins of its flagship Chicago Tribune and, in particular, its Orlando Sentinel and South Florida Sun-Sentinel.

The company's biggest expansion, in 2000, would become its most problematic. It bought out the Chandler family's Times Mirror Co. for $8 billion – acquiring newspapers including the Times, the Baltimore Sun and Newsday of Long Island.

Although those papers had fine journalistic reputations, they did not produce the stellar profit margins that had been the norm for most Tribune publications. The combined company hoped to attract an audience and advertisers because of its ownership of newspapers and television stations in the three largest markets – New York, Los Angeles and Chicago.

But the new Tribune was immediately hit by a national recession, and the hoped-for synergies paled in comparison to expectations. The company might have considered a sale of its assets but had held most for so long that the potential capital gains taxes would have been devastating.

The seven independent directors who oversaw the deal (minus three Chandler family representatives and Chief Executive Dennis FitzSimons) focused instead on the sale of all of Tribune. They received offers in January from the Burkle-Broad partnership and from the Chandlers but found that both amounted to reorganizations that did not offer a premium and that the company could accomplish on its own.