| |

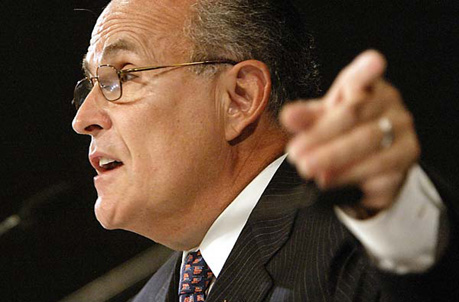

Giuliani Boasts of Surplus; Reality Is More Complex

Rudolph W. Giuliani has been broadcasting radio advertisements in Iowa and other states far from the city he once led stating that as mayor of New York, he “turned a $2.3 billion deficit into a multibillion dollar surplus.”

The assertion, which Mr. Giuliani has repeated on the trail as he has promoted his fiscal conservatism, is somewhat misleading, independent fiscal monitors said. In fact, Mr. Giuliani left his successor, Michael R. Bloomberg, with a bigger deficit than the one Mr. Giuliani had to deal with when he arrived in 1994. And that deficit would have been large even if the city had not been attacked on Sept. 11, 2001.

“He inherited a gap, and he left a gap for his successor,” Ronnie Lowenstein, the director of the city’s Independent Budget Office, a nonpartisan agency that monitors the city budget, said of Mr. Giuliani. “The city was budgeting as though the good times were not going to end, but sooner or later they always do.”

The Giuliani campaign defended the advertisement, noting that it merely states that Mr. Giuliani created a multibillion-dollar surplus, not that he passed one on to his successor.

Mr. Giuliani’s eight years of fiscal stewardship of the city was initially marked by a new brand of conservative budgeting principles in which he cut spending, cut taxes and cut the payroll. Later, when the booming stock market of the late 1990s pumped revenues into the city’s coffers, Mr. Giuliani was able to cut taxes, increase spending above the rate of inflation, and still post big surpluses.

But the economy cooled near the end of Mr. Giuliani’s second term, and he spent most of the roughly $3 billion surplus he had accumulated to balance his final budget, for the fiscal year ending June 30, 2002. Even before the Sept. 11 attacks, Mr. Giuliani projected that his successor would face a $2.8 billion gap the next year. After the attacks, that gap climbed to $4.8 billion in a $42.3 billion budget.

Faced with such a huge deficit, which continued to grow as the economic aftershocks of the attacks continued and the costs of some of the Giuliani administration’s policies came due, the next mayor, Mr. Bloomberg, was forced to take the extraordinary steps of borrowing to pay for operating expenses, cutting programs, and raising property taxes by 18.5 percent to balance the budget.

Joseph J. Lhota, a former budget director and deputy mayor to Mr. Giuliani, said that Mr. Giuliani kept the rate of spending growth during his eight years in office below that of the state and federal governments, and most other states. Mr. Lhota credited Mr. Giuliani with making tax cuts a priority for the city — Mr. Giuliani often speaks of having cut taxes 23 times — and of using the budget to push his priorities, like beefing up public safety.

“Prior to Mayor Giuliani, there never was a discussion of lowering taxes in New York,” Mr. Lhota said. “By the end the debate became, ‘Which taxes should we cut?’ ”

Mr. Lhota said that the Giuliani administration cut the budget shortly before leaving office to leave the city in a better position. He noted that the fiscal year in which Mr. Bloomberg took over from Mr. Giuliani ended with a surplus of $677 million. But that surplus was fed in part by nearly $500 million in borrowing by the Bloomberg administration. And it made only a small dent in the huge gap Mr. Bloomberg had to close that June in his first budget — a gap inherited from the Giuliani administration, much of which was expected even before Sept. 11.

Mr. Giuliani often promotes his fiscal conservatism on the campaign trail to try to appeal to Republican voters who might be wary of his support of abortion rights, gun control and gay rights. But an examination of his fiscal record as mayor of New York City shows that his legacy defies easy ideological labeling.

Mr. Giuliani took office in 1994 and immediately administered a strong dose of fiscally conservative policies on a city known for generous social services programs and union contracts. The city was near the end of a long economic downturn, and Mr. Giuliani cut taxes while slashing the work force and curbing spending to close the $2.3 billion budget gap he inherited.

Mr. Lhota said the administration faced a severe cash crunch when it took office. Abraham M. Lackman, Mr. Giuliani’s first budget director, said that in addition to having to close a $2.3 billion deficit in its first budget, the administration took office worrying that it might not have enough cash on hand to meet payroll because some of the revenues that were counted on in the inherited budget were not likely to materialize.

Mr. Giuliani pushed through an austere budget that year. He went on to push mergers of city agencies, incorporating the old transit and housing police forces into the New York Police Department. He sold the city’s television station. And he cut taxes.

But Mr. Giuliani eased up on the reins of spending during his second term, as the stock market boom pumped tax revenues into the city coffers. An analysis by the Citizens Budget Commission, a business-backed fiscal watchdog group, found that spending rose an average of 6.3 percent a year during Mr. Giuliani’s second term — well above the rate of inflation. And Mr. Giuliani went on a hiring spree, in the end leaving the city work force slightly bigger than he found it, but changing its composition by adding more teachers and police officers while shedding jobs in social services agencies.

In 2000, near the height of the stock market boom, Mr. Giuliani supported a measure to put less money in the pension funds for the city’s retirees. By recognizing the funds’ investment gains at once — instead of phasing them in over years to smooth out sharp gains and losses — he was able to spend $800 million over two years that the city otherwise would have had to invest in its pension funds. Fiscal monitors, including the city comptroller’s office, warned that the practice was irresponsible, because the money could be needed to cushion the blow of a market downturn.

To win the support of the city’s unions, which needed to sign off on the pension change, Mr. Giuliani agreed to sweeten the pensions of city workers, eliminating the payments that some were required to contribute to the pension system and giving others up to two years of credit toward their retirements.

“I’ve never had a negotiation that went so smoothly or so effectively,” recalled Randi Weingarten, who had a seat at the table as the chairwoman of the Municipal Labor Committee, an umbrella group of city unions.

But when Mr. Bloomberg took office amid a deteriorating economy, the value of the pension funds dropped significantly, forcing the new mayor to pump more money into them when the city could least afford to.

Long before Sept. 11, fiscal monitors warned that Mr. Giuliani’s last budget would leave his successor facing a big gap. In the spring of 2001, the state comptroller’s office said that the city was projecting the largest out-year gaps in a generation.

E. J. McMahon, a senior fellow at the Manhattan Institute, a conservative research organization that has often been supportive of Mr. Giuliani, wrote an article that July warning that “Seven years after Mayor Giuliani led New York out of its last fiscal crisis, the city’s budget has now come almost full circle.”