NEW YORK (CNNMoney.com) -- Has the online video shakeout only begun or is the bubble about to burst?

Google's $1.65 billion agreement to acquire YouTube Monday is the latest, splashiest and most expensive of deals involving companies in the nascent online video business.

Industry experts say that Google's rivals, both traditional media companies and Internet firms like Yahoo!, need to reevaluate their online video strategies now that the search engine kingpin and online video leader have joined forces.

"I think certainly there is going to be a lot of activity. I don't think anybody wants to cede the market to Google and there are a lot of media companies that are poised to do something," said Greg Kostello, founder and CEO of vMix, a privately held video site.

But some caution that media companies also have to be careful of overpaying.

"You do need to react to this deal if you are a competitor but it's just a matter of how. Google is inflating the value of the market overall because they can afford to do so," said Bill Wise, chief executive officer of Did-it Search Marketing, a paid search advertising firm based in New York.

The $1.65 billion price tag for YouTube may in fact mark the beginning of the end for this latest dot-com craze. Instead of forcing other media firms to make acquisitions, it could scare them off.

"YouTube is a 67-person company in an unproven market that hasn't made any money. So it's seemingly ridiculous amount of money to spend," Wise said.

To that end, other privately held online video search firms with a notable amount of traffic, companies like Metacafe, Heavy.com, Guba and Break.com, could find themselves being able to command much higher prices in a sale than they would have before Google bought YouTube.

"For any of YouTube's competitors, they have to be doing back flips," said Michael Goodman, program manager of digital entertainment with Yankee Group, a tech research firm. "If you are another video sharing site, you have to be thinking please let there be someone else out there that wants to buy."

David Carson, the co-CEO of Heavy.com, agreed that the price Google (Charts) was willing to pay for YouTube caught many by surprise.

"The deal is pretty significant in many ways. It certainly made everyone stop and pay attention. Nobody was expecting the valuation to be as high as what it was," he said.

Carson said that Heavy.com, which has been the subject of takeover rumors with companies such as Viacom (Charts), News Corp. (Charts) and Yahoo (Charts) often mentioned as suitors, is not looking to sell but that he would entertain the thought of a sale if a good exit strategy presented itself.

So will any of Google's competitors be willing to spend to keep pace with Google? Scott Kessler, an equity analyst with Standard & Poor's, says that Yahoo, which warned of softness in the online ad market last month and has also been hit by delays to its important new search advertising platform, may have no choice but to make a move.

Yahoo has been rumored to be in talks to buy social networking site Facebook and could be forced to make a move sooner rather than later. A spokesperson for Yahoo was not immediately available for comment.

"This increases the pressure on Yahoo to do something. There is this perception that Google is not just executing well but that it is also being more aggressive," Kessler said.

Other companies may not have to make such drastic moves though.

Microsoft (Charts), which was said to be interested in YouTube, announced last month that it was starting a YouTube rival called Soapbox. And late yesterday, the company said in a statement that it has no plans to make an online video acquisition to counter Google's move.

"We evaluated acquiring this type of technology several months ago. We decided to build our own offering, focused on driving better customer and advertiser experiences through integration with Microsoft assets and services that reach an estimated global audience of 465 million consumers," a Microsoft spokesman said.

"We are excited about the potential we are seeing in the beta of Soapbox on MSN and believe building our own solution is a more cost-effective way to compete in this new space," the spokesman added.

However, Wise said that if Soapbox flops, Microsoft could be the one company that can go out and match Google with a big deal of its own.

"The only company that can potentially keep up with the rising prices that Google has set is Microsoft. It will be interesting to see what Microsoft does in response to this," he said.

Analysts said that News Corp., which owns the popular MySpace social networking site, has quickly built its MySpace Videos site to the number two spot behind YouTube. So it probably doesn't need to make a deal and should just concentrate on promoting MySpace more aggressively.

"News Corp. already has a burgeoning online video business with MySpace," said Kessler. A spokeswoman for Fox Interactive Media, the News Corp unit that includes MySpace, had no comment about the Google-YouTube deal.

Other media firms have also been increasing their presence in the online video market and could step up their investments even further since they have only spent a relatively small amount so far.

Sony bought online video sharing site Grouper in August for just $65 million. Viacom bought iFilm last year and Atom Entertainment in August for a combined $250 million.

And AOL, which like CNNMoney.com is a unit of Time Warner (Charts), has bought a slew of online video assets lately, most recently video search firm Truveo and online video advertising company Lightningcast. Terms of those deals were not disclosed but sources estimated that AOL paid about $50 million for Truveo.

"There will be acquisitions from the big boys. Video needs to be a component of any serious Internet player," said Eric Chin, a partner with Bay Partners, a venture capital firm based in Cupertino, Calif.

And Heavy.com's Carson said that larger media companies may wind up looking to scoop up some of the remaining online video sharing sites because they feel that it is easier to purchase an existing business than invest in building up their own.

"I think some media conglomerates will make smaller acquisitions and you might see some that make some surprising moves based on the YouTube deal. Some companies are starting to realize that maybe they have to buy," he said.

To be sure, YouTube, which has more than 100 million videos downloaded a day and commands nearly half the share of the online video market, was the most sought after of all the privately held video sites. It is the proverbial flavor of the month.

But Yankee Group's Goodman pointed out that News Corp. paid only $590 million for MySpace last year.

"Is this an Internet boom or bust? When you see a nearly three times increase in what Google paid for YouTube than what News Corp paid for MySpace for a company with even less of a business model than MySpace, you have to ask those questions. This could be the precursor of the Internet bust part 2," he said.

| |

Adding On to the House of Google

SAN FRANCISCO, Oct. 9 — Google has made it a point to promote a culture of small engineering teams given free time to create new products — a strategy that it has argued will make the company more innovative than other top-down organizations.

But beginning well before its initial public offering in 2004, Google has not shied away from buying rather than building. It has made more than 15 major acquisitions in areas as diverse as blogging, personalized search, satellite imagery, image management and cellular phone technology.

And now, having pieced together a rapidly multiplying set of products, Google’s leaders have a new concern. Call it Google sprawl.

Only last week, the founders, Sergey Brin and Larry Page, and the chairman and chief executive, Eric E. Schmidt, spoke of their concern that the growing collection was confusing users. They noted that new products found one level down from Google’s famously Spartan home page drew far less attention and traffic than they would like.

The answer, they stated, will increasingly be to fold new services and products into existing applications as additional features. But that approach will be put to the test — indeed, may even conflict — with its largest deal yet, the $1.65 billion acquisition of YouTube.

The deal presented Google with a difficult choice: Integrate YouTube into Google and risk losing one of the hottest brands on the Internet, or leave YouTube independent and risk diluting its own powerful brand?

For now, anyway, Google says YouTube will remain independent, retaining a “distinct brand identity” and complementing its own existing video business, Google Video.

But while the company described Google Video on Monday as “fast growing,” it has had trouble getting traction among Web video services, trailing far behind YouTube and MySpace. And one reason may be that it is just one of many offerings housed underneath the Google roof.

At a briefing for journalists last Thursday, Google’s executives said the biggest risk to the company was the loss of the simplicity that was crucial to building the company’s brand.

“One of the things that is going to have to happen is simplicity,” Mr. Brin said. “It’s one of the reasons that people gravitated to Google initially.”

Indeed, for all of Google’s innovations and additions — like Google Earth, the satellite-mapping service that grew out of an acquisition, or Google Finance, its home-grown financial news site — it is still its search engine that drives the overwhelming share of its use.

According to Alexa, a Web information company, 72 percent of those who use Google.com do so to search from its home page. Another 10 percent use it for e-mail and 8 percent for its Web-based image search. Video has been a straggler, at 3 percent.

That helps explain the motivation for a YouTube deal. But with the stable of talent that Google has built, why not develop its own YouTube?

Its engineering teams have, after all, created services, including Google Calendar, Mail and Spreadsheet as well as language translation technology built into Google’s search engine. More than a dozen services — including Google Video, Google Maps and Google Desktop Search — have come from the company’s advanced research arm, Google Labs.

But those creations are complemented, if not overshadowed, by its acquisitions. Still, except for Google Earth, not one has become an unqualified success or market leader.

Moreover, with the exception of advertising-related technology acquisitions, Google has yet to develop significant revenue streams from its acquisitions. Its Picasa image management program allows users to purchase photo prints, and the company sells a commercial version of Google Earth for $400, but neither of those are major businesses yet.

YouTube is different from Google’s previous acquisitions not because it has a proven business model — it does not — but because it comes with an established audience.

Google executives generally answer questions about acquisitions by saying that the company is still experimenting with business plans, or by arguing that a program like Sketch-Up — a simple computer-aided design program — will have an indirect revenue impact by making the entire Google service more valuable.

Its pattern until now of integrating new features into existing products has an obvious parallel with the successful strategy that Microsoft followed during the 1980’s in continuously adding features to its MS-DOS and Windows operating systems and to its Office software package.

The strategy backfired in the mid-1990’s when the Justice Department charged Microsoft with monopoly practices after it tried to integrate the Web browser, which had been popularized by Netscape Communications, into Windows.

Mr. Schmidt, Google’s chairman, insisted that the company would not follow a similar strategy, in part because it had established a principle of not trying to control or lock up user-owned information — like calendar or spreadsheet data — that could be moved to an alternative service.

“We at Google will never trap user data,” he said.

Now, like Microsoft before it, Google is rapidly expanding into new arenas. And that presses home the challenge facing the company: that almost all of its influence and revenue still come from a single choke point, its search command line.

“What does a video storage service have to do with search?” asked Jakob Nielsen, a principal of Nielsen Norman Group, a user-oriented design group.

Last week, before reports of an impending YouTube deal surfaced, one of Google’s founders, Mr. Brin, tried to answer just that question.

Acknowledging that as a Stanford student he had experimented with lock-picking techniques, a relatively common pastime for computer hackers, he mentioned a resource unavailable to him then.

“Google Video turned out the best way to learn about this new technique,” he said.

In YouTube Deal, Google Beats Yahoo at Its Own Media Game

By Chris Gaither and Dawn C. ChmielewskiTimes Staff Writers

October 11, 2006

In outmaneuvering Yahoo Inc. to buy YouTube Inc., search giant Google Inc. is declaring its intention to become Hollywood's online partner of choice.

Led by former movie mogul Terry Semel, Yahoo has spent the last two years hiring show business executives and opening a big Santa Monica campus to build on its early lead in connecting Web surfers with music, movie trailers and TV clips.

Yahoo had placed its own bid for YouTube, hoping to guard its turf in online entertainment. But Google snapped up the popular site for watching and sharing online videos. In addition to filling Google's void in online entertainment, the proposed $1.65-billion acquisition would give the search giant inventory for display and video ads, an area in which it has trailed Yahoo.

"It certainly looks as if Yahoo is the real loser in this," Needham & Co. analyst Mark May said. "They can now be considered a major laggard in the online video category."

Analysts said Yahoo's failure to acquire YouTube was the latest in a string of missteps that had widened the competitive gap with Google. In the last few months, Mountain View, Calif.-based Google has also made content distribution deals with Viacom Inc. and record labels and signed on as the advertising broker for News Corp.'s Fox Interactive Media, owner of social-networking site MySpace.

Meanwhile, Sunnyvale, Calif.-based Yahoo delayed the launch of a search-advertising system designed to compete with Google, then warned of a third-quarter revenue shortfall. It acquired a small video-editing firm, Jumpcut, but failed to consummate its courtship of the two biggest Internet communities available: YouTube and Facebook.

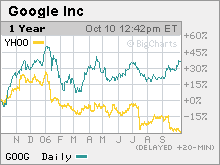

The stock valuations of the two companies reflect their divergent momentum: Google is worth $130 billion, compared with Yahoo's $34 billion. Yahoo shares fell 56 cents, or 2.2%, to $24.47 on Tuesday, down nearly 40% this year, while Google shares fell $2.35 to $426.65. Its shares are up about 3% this year.

"While Google seems to be firing on all cylinders, not only has Yahoo had its fair share of execution problems, but they also seem to have had an impact on the company's ability to move quickly on big actions like a potential acquisition of Facebook," said Scott Kessler, an analyst with Standard & Poor's.

The hefty price Google paid for YouTube evoked memories of the Internet bubble of the late 1990s, analysts said. But many said Google could afford to make that bet to keep YouTube away from other suitors, which included News Corp. and Viacom.

Deutsche Bank analyst Jeetil Patel criticized Yahoo for letting YouTube slip away, saying it would have been a much better home for the video-sharing service. He attributed the failure to cultural differences between the companies and Yahoo's unwillingness to fork over big bucks for a potentially useful property.

A Yahoo spokeswoman would not comment on the YouTube deal but said Yahoo was not ceding any ground to Google in show business relationships.

"We believe that Yahoo continues to be a partner of choice for media companies," spokeswoman Joanna Stevens said.

For example, she said, Yahoo TV is the most-visited site for television-related information, with promotional clips and full shows. Yahoo also runs the Web's most popular music site.

Laura Martin, an analyst with Soleil Media Metrics, said Yahoo still held the edge in entertainment. "People think of Yahoo as much more of an online content provider," she said, adding that Google's YouTube purchase was the first sign it planned to pursue a strategy similar to Yahoo's.

| |

Yahoo Feels Breath on Neck

As Google whips out its fat wallet to buy the video site YouTube, it is making Yahoo look even more out of step with the fast-changing Internet advertising market.

Yahoo itself tried to buy YouTube just a few weeks ago and got as close as negotiating price and terms, according to an executive briefed on the discussions. But the talks broke down, and Google swooped in and closed the deal quickly, just as it has in several recent partnership negotiations. Indeed, many Internet executives are noting just how often Yahoo appears to be late and slow, both in its own business and in negotiations with other companies.

Yahoo would seem to have a strong hand. It is the world’s most popular Web site, with more than 400 million monthly users and a major seller of advertising for its own and other sites. It has top Web properties in areas like e-mail messaging and music. And its management team, led by Terry S. Semel, a former Hollywood executive, is well regarded for its skill and financial rigor.

But in recent months the company has suffered some embarrassing setbacks in its sales of both display and Web search advertising. Many advertising industry executives say Yahoo’s lead in working with big marketers has eroded as other companies have built up popular Web sites, sales operations and advertising technology.

“Yahoo has lost the favor it enjoyed a year or two ago,” said David Cohen, a senior vice president of Universal McCann, a media buying agency of the Interpublic Group. He said his clients were reducing the share of their budgets they allocate to Yahoo in favor of newer sites, like MySpace, and sites developed by big media companies like Viacom.

“There are more players in town, and the others are closing the gap relative to the things Yahoo is good at,” Mr. Cohen said.

But the problems at Yahoo go beyond advertising. From video programming to social networking — areas of interest to users and advertisers alike — the company is losing its initiative. And each time a product fails in the market or is late, Yahoo loses some ability to do more deals and hire more talented employees. The shares are down 38 percent this year, sending some employees out the door in search of better shots at stock market wealth.

Google, in the meantime, is taking advantage of Yahoo’s problems to cement crucial deals that could make its rival’s recovery even more difficult. Before Google agreed to buy YouTube for $1.65 billion in stock, it paid $1 billion for 5 percent of AOL, locking in the right to sell text ads that appear next to its search results. And it agreed to pay $900 million over three and a half years to sell ads on MySpace.com, giving it a huge number of pages where it can place banner ads. (Yahoo flirted with AOL and bid actively for MySpace.)

With these and other deals, Google has neutralized Yahoo’s big competitive advantage on Madison Avenue: its ability to sell the full range of advertising, from splashy video campaigns to text ads on search results.

Joanna Stevens, a spokeswoman for Yahoo, said that no Yahoo executive would comment for this article.

“We feel our business is very strong, even if we are not growing at the rates at which the financial community is expecting us to,” Ms. Stevens said. “Of course growth will slow when you already reach one out of two people on the Internet.” She said that Yahoo frequently discusses business arrangements with other Internet companies, but declined to discuss any potential negotiations with YouTube.

Yahoo has been stymied because its text advertising business has been largely frozen until it completes a new software system. The upgrade is more than a year late and the delay has sucked up the company’s engineering resources and prevented it from developing new advertising products. Yahoo’s system produces much less money from every page than Google, a handicap in bidding for advertising deals.

Moreover, Google has grown so much wealthier and has so much more stock market value, it can afford to make deals that would be much more risky for Yahoo, said Jordan Rohan, an analyst for RBC Capital Markets.

Google has $11 billion in cash and a market value of $131 billion, while Yahoo has $4 billion in cash and is worth $34 billion. “In poker terms, Google is the dominating chip stack,” Mr. Rohan said.

Some analysts argue that Yahoo needs some bold moves to signal to investors, advertisers and customers its commitment to innovation. Its growth in users is slowing. The United States audience grew just 6.5 percent in September from a year earlier, to 106 million unique visitors, while Google’s grew 25 percent.

Yahoo has made several overtures to buy Facebook, a social networking site popular among college students. This would help compensate for the failure of Yahoo’s own social network — Yahoo 360 — to find a place in the market. It could also expand Yahoo’s appeal to young people, an area in which it has slipped.

But Mr. Rohan said it would be a mistake to respond to the Google-YouTube deal with a big offer for Facebook. “Facebook is a nice small business,” he said. “I would prefer they spend less than $1 billion for it.”

The company’s stumbles are a puzzle, as Mr. Semel is widely considered to have built a mature and disciplined management team. He led the company out of the collapse of the Internet ad market and built a credible Internet search unit after it became clear that Google was more a rival than a partner. But in this market, what was once admirable discipline may now look like timidity.

Yahoo may well be slipping because of the sheer scope of its ambitions. It competes in news with CNN, in sports with ESPN, in e-mail with Microsoft, in instant messaging with AOL, in social networking with MySpace, and of course in searching with Google. And it does so in dozens of countries.

“It’s hard to figure out what they want to be when they grow up, even though they are grown up now,” said Tim Hanlon, a senior vice president of Denuo, the media futures consulting arm of the Publicis Groupe. “Are they a content company? Are they a services company? Or are they a portal to other things? You ask three people and you may get three different answers.”

Current and former Yahoo employees say the company has been bogged down by bureaucracy and internal squabbling. For example, the media group, which handles video programming, and the search group, which has a system to find videos on the Web, both wanted to offer a service for users to upload their own video clips. The search group won, but the delay allowed YouTube, a start-up, to dominate the market.

“When you become Yahoo’s size, you become a little complacent, a little fat and happy,” said Youssef H. Squali, an analyst for Jefferies & Company.

Companies that try to do deals with Yahoo also say they find it to be slow, demanding and inconsistent in negotiations. The discussions with YouTube floundered, in part, over Yahoo’s demands for assurances over how YouTube would handle copyrighted material, concerns that were not so important to Google, the executive briefed on the negotiations said.

“They can’t close a deal,” said a top executive of a large media company who said he was frustrated because negotiations over a partnership with Yahoo had bogged down. “They are smart guys, but they are having real problems,” said the executive, who declined to be identified because his company has other dealings with Yahoo.

Yahoo’s faltering image and plunging stock price may also be hurting its ability to recruit talented people. “A lot of entrepreneurs I talk to would rather work for a hypergrowth technology company than what they consider — and this is funny — a stodgy old Internet company,” Mr. Squali said.

Yahoo’s existing employees are grumbling that with the stock price so low, many of their options have become worthless. Some Yahoo veterans have bolted for trendier start-ups. For example, Mike Murphy, a longtime ad salesman, is now the chief revenue officer of Facebook, and Gideon Yu, Yahoo’s treasurer, quit last month to become chief financial officer of YouTube.

“They woke up and realized they had an attrition problem,” said one executive who quit for a start-up this year.

Yahoo has responded by giving substantial raises to favored executives it wants to keep, according to one current executive who spoke on the condition of anonymity because he did not want to jeopardize the raise he received.

Yahoo has also had trouble developing many new offerings that capitalize on the latest trends on the Web and offer innovative formats for advertisers. Many marketers, for example, have become intrigued by the possibilities of weaving their products into the fabric of social networking sites. Even more, they are sponsoring original Internet content, especially video programs.

Two years ago, Yahoo made an expansion in Hollywood in an attempt to produce new video-focused Web sites, but it later backed off from the plan amid internal bickering.

Perhaps the biggest area of strategic confusion for Yahoo is its advertising network, which sells ads on other sites. Its Yahoo Search Marketing division has been falling further and further behind Google in selling text ads on other search sites. Yahoo lost a major source of attractive search pages when MSN began selling its own ads this year. And the Yahoo Publisher Network, which is meant to sell ads on blogs, news sites and other content pages, has languished. Dow Jones, for example, withdrew The Wall Street Journal and other sites out of the Yahoo network this spring, hiring Seevast, a small New York firm, instead.

Moreover, Yahoo has made few moves to expand its ad network to sell other types of advertisements like banners and video commercials, even though it is a leader in selling such ads on its own site. With a plethora of blogs and Web publishers looking to earn money from their efforts, there is a booming business in selling ads for these sites. AOL has made a major play in this field, buying the leading banner network, Advertising.com, and Lightningcast, a video network.

Google has moved to expand its network from text ads to selling banners and video ads, and the YouTube purchase will no doubt accelerate its push into video. Moreover, Google wants to sell ads in print, radio and soon traditional television as well.

“Google is so much ahead,” said Peter Hershberg, a managing partner of Reprise Media, a search advertising agency. “Google is going into new channels like video and Yahoo is still trying to fix their core channel.”